T100

A complete customer lifecycle management system for SMEs in the financial services arena.

t100 supports and stores KYC information from the first customer communication (prospect stage) through information gathering, carrying out due diligence, identity checks, sanction and risk checks, through on-going monitoring, trading pattern analysis, financial reporting, tax reporting and AML reporting.

The system is aware of current legislation and regulatory requirements and proactively monitors all client activity creating alerts whenever any user defined threshold is breached. In addition to a range of standard reporting, such as the annual Financial Crime Report, users can create their own reports by selecting the fields they require from the database. The system was designed and built from scratch in 2017 by Thames Systems Limited in partnership with a global clearer.

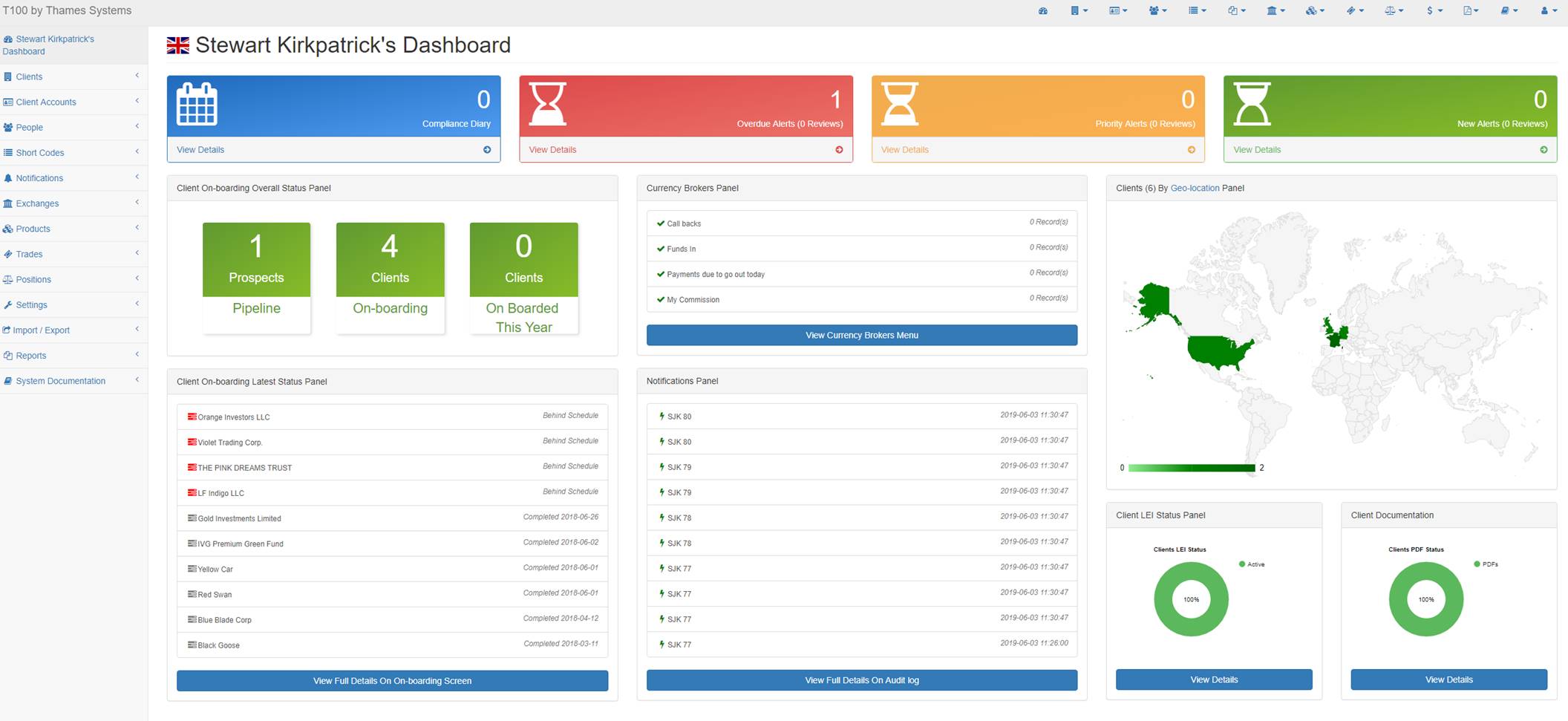

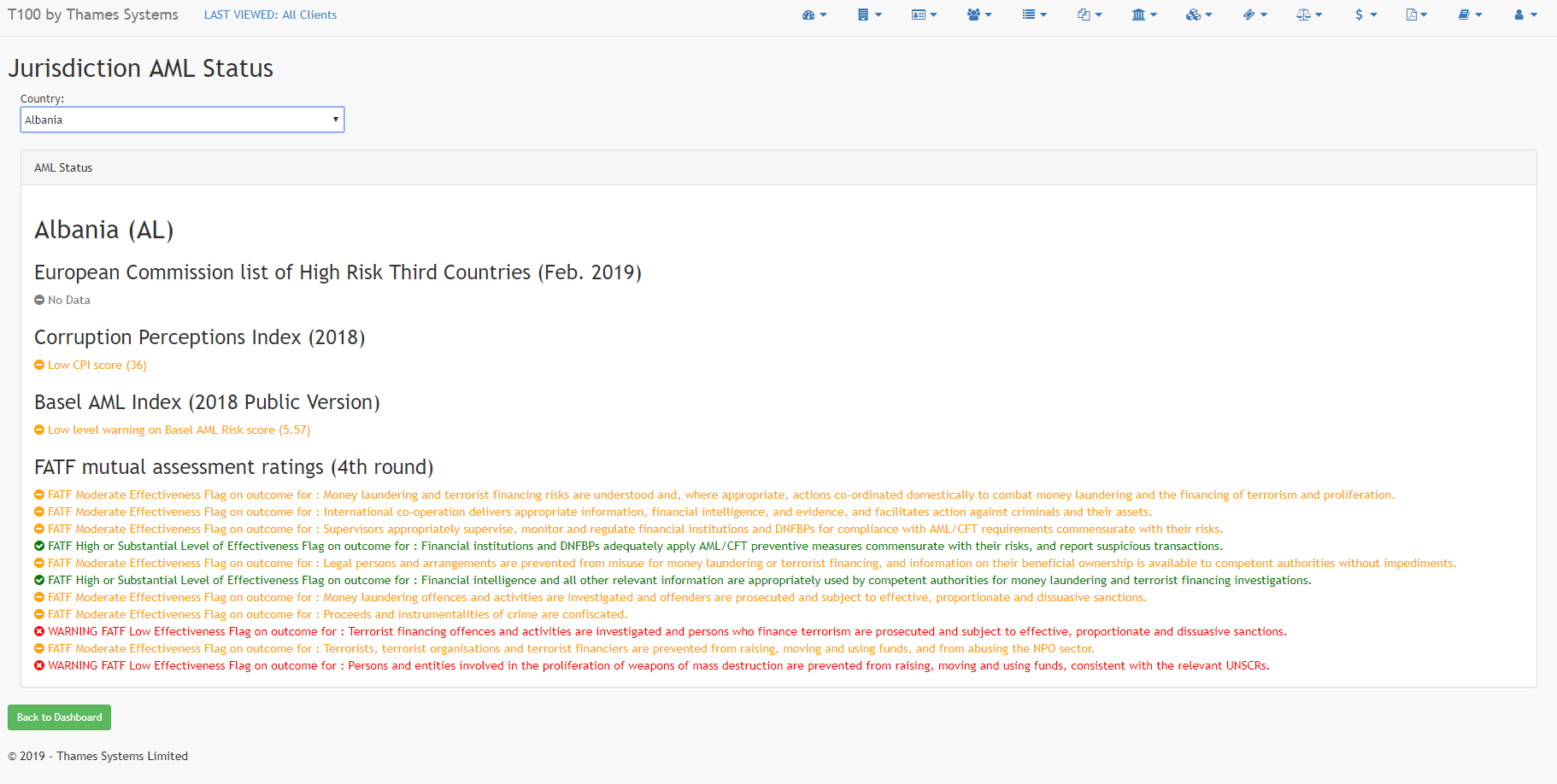

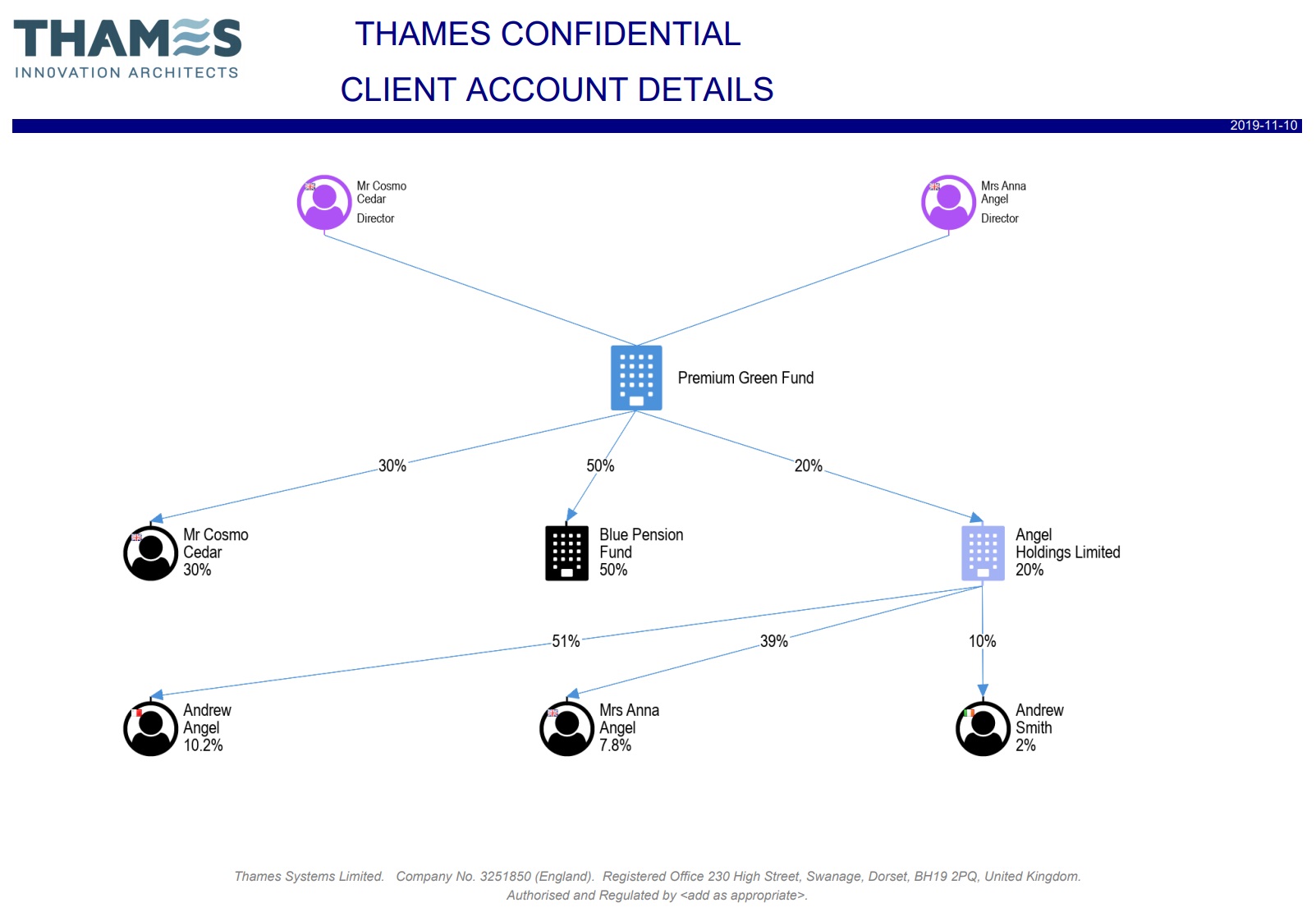

Screenshots

At a glance

Functionality

Built in CRM

Customer Portal

Full Suite of KYC Features

AML Monitoring

Configurable Dashboards

Tax and Regulatory Reporting

Data Integrity Checks

Rules Based Alerts

Client Review Tools

Compliance Diary

User Reports

Automated Company Structure Diagrams

Support

Bespoke Development Packages

Standard UK Hours Included

Extended Support Available

Security

ISO27001 Certified Data Centre

Strong Customer Authentication

Data Encryption

Firewall Controlled Access

Daily Vulnerability Scanning

Encrypted Remote Backup

International

Multiple Language and Character Set Support

ISO 3166 Country Codes

Multi-Currency Support

CRS and FATCA Reporting

HKFE Established Client Monitoring